The Penny Holder

Should You Open a Roth IRA for Kids?

By Saghir A. Aslam

Rawalpindi, Pakistan

(The following information is provided solely to educate the Muslim community about investing and financial planning. It is hoped that the Ummah will benefit from this effort through greater financial empowerment, enabling the community to live in security and dignity and fulfill their religious and moral obligations towards charitable activities)

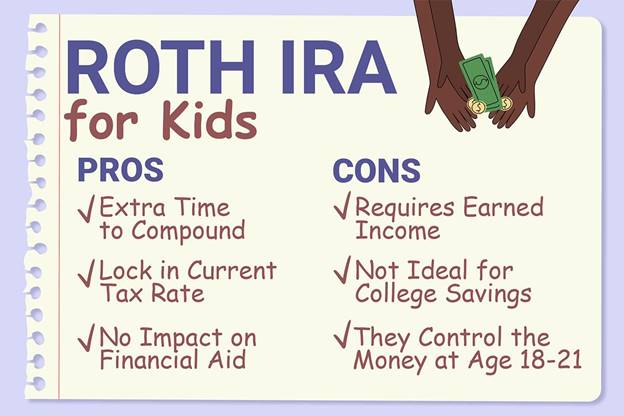

It may seem premature to help your children prepare for retirement before they’ve even graduated from high school. But thinking about ways to help them save now — including opening a Roth IRA for them — may help provide a significant head start on saving for retirement.

Kids have more time on their side, which can be a big advantage, IRA product manager for Wells Fargo Advisors, says. The money set aside in a Roth IRA for kids may compound and grow tax-free for decades. “The earlier they get the money in, the more it could work for them. Every little bit helps later in life.

Consider this: A one-time contribution of $1,000 to a Roth IRA could grow to more than $12,000 in 50 years, assuming a conservative 5% annual investment return and monthly compounding.

Now imagine the total if your child made annual contributions. It’s best to work with your tax advisor with any eligible Roth IRA contribution amounts for a minor.

Here are a few other things to keep in mind regarding setting up a Roth IRA for kids.

Your child must have earned income

Kids of any age can contribute to a Roth IRA as long as they have earned income. It can be income and wages earned from a W-2 job. Self-employment income from a yardwork or babysitting business can qualify as well, as long as it’s classified as earned income reported to the IRS.

There are no age limits

Even babies can have Roth IRAs, as long as they have income. Yes, babies. For example, a couple whose young son received compensation after being cast in a commercial. The couple funded a Roth IRA with the money. That’s an uncommon case, however. In most cases, children aren’t earning income until they’re older.

There are contribution limits

In 2023, the contribution limit to a Roth IRA is $6,500 a year or the total of earned income — whichever is less. For example, if your child earns $1,000 babysitting in 2023, the contribution toward a Roth IRA is capped at that $1,000 amount.

Other benefits beyond retirement

Many parents don’t realize that the money in a Roth IRA for a child can be used for more than just retirement. For example, your child can take out contributions, or principal amounts, from the Roth IRA for any reason without taxes or penalty.

Under IRS rules, children can also tap into earnings without incurring an early withdrawal penalty if the money is used for qualified higher education expenses, but they may have to pay income tax on those distributions.

Another exception allows your child to withdraw up to $10,000 of earnings for a first-time home purchase without paying income tax or a penalty. But be sure to discuss this further with your tax consultant.

Keep in mind that your child will receive full control of the account once they are a legal adult. You can surprise them with it when they turn 18 or reach the legal adult age in your state or use the account as a tool to teach them about saving and investing as they grow from child to teen to legal adult.

“You give your child a head start by building their retirement early, or maybe your child taps some of the principal to pay for school or to start their own business. Whatever’s decided, a Roth IRA can be an excellent long-term tool with a lot of flexibility.

(Saghir A. Aslam only explains strategies and formulas that he has been using. He is merely providing information, and NO ADVICE is given. Mr Aslam does not endorse or recommend any broker, brokerage firm, or any investment at all, nor does he suggest that anyone will earn a profit when or if they purchase stocks, bonds or any other investments. All stocks or investment vehicles mentioned are for illustrative purposes only. Mr Aslam is not an attorney, accountant, real estate broker, stockbroker, investment advisor, or certified financial planner. Mr Aslam does not have anything for sale. Saghir Aslam has dedicated himself to social welfare activities since 1965 and serves as the founding chairman of Saba Homes, honoring and empowering the orphans.)