|

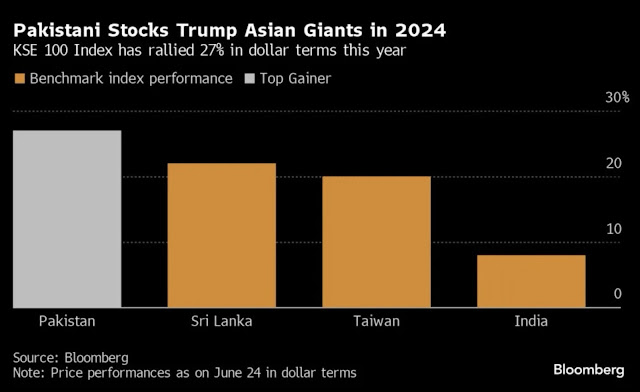

Pakistani stock market outperforms Asian peers - Source Bloomberg |

Investors Celebrate Pakistan's Continuing Economic Recovery

By Riaz Haq

CA

Pakistan's benchmark KSE-100 index hit an all-time high after the announcement of the $7 billion IMF bailout deal. Economic indicators such as inflation, exports, and remittances are also showing significant improvement as well. Speaking to reporters after the IMF deal, the Fund Managing Director Kristalina Georgieva acknowledged the progress made by Pakistan. She said, "The economy is on the sound path. Growth is up and inflation is down". The KSE-100 index rose in early trade to a record high of 82,905.73 points, before giving up those gains later in the day to close 0.7% down at 81,657. It still represents an annual gain of nearly 100%.

Pakistan rupee has remained essentially stable at around Rs 277 to a US dollar over the last one year. Inflation has come down from 37% last year to less than 10% this year. Exports have climbed 10.54% ($2.921 billion) to $30.645 billion during the fiscal year 2023-24 compared to $27.724 billion in the corresponding period of 2022-23. Overseas workers' remittances have surged 44% to $5.94 billion in the first two months (July-August) of the current fiscal year 2024-25, compared to the same period last year. The current account deficit has declined to $681 million in FY24 from $3.275 billion in FY23. The budget deficit for the 2023–2024 fiscal year has been reduced to 6.8% of GDP from 7.7% in the previous year.

The stock market gains are driven primarily by the increasing profitability of the firms making up the index, in addition to improvement in macroeconomic indicators. The companies listed on Pakistan’s KSE-100 Index have reported their highest-ever earnings of Rs1.7 trillion in FY24, marking a 25% year-on-year increase from Rs1.3 trillion in FY23. In US dollar terms, profits after tax (PAT) rose 10% to $5.8 billion during the same period, according to data compiled by brokerage firm Topline Securities. Dividend payouts soared 30% as banking, fertilizer, and cement sectors led growth, according to media reports.

Pakistan has a long tough road ahead to carry out the reforms promised to the IMF in the latest bailout deal. Renegotiating unsustainable IPP (Independent Power Producers) contracts and carrying out long-delayed privatization of state-owned enterprises to reduce the major drain on the taxpayers will not be easy. Boosting tax collection is not easy either. Offering incentives for savings, investments, and exports while reducing budget deficits is a difficult task. It will take a lot of fortitude, finesse, and political will to get results to improve the economy. Pakistani leaders' biggest challenge is to find a way to grow the economy to create enough jobs for the country's growing working-age population. Failure to do so could cause major social unrest in the nuclear-armed country of 240 million people.

(Riaz Haq is a Silicon Valley-based Pakistani-American analyst and writer. He blogs at www.riazhaq.com)