Image Linkedin

Pakistan's Digital Public Infrastructure Initiative Transforming Lives

By Riaz Haq

CA

Pakistan's journey to build a digital public infrastructure (DPI) began in March 2000 with the establishment of NADRA, the National Database and Registration Authority. The Gates Foundation defines DPI as follows: "DPI is a digital network that enables countries to safely and efficiently deliver economic opportunities and social services to all residents. DPI can be compared to roads, which form a physical network that connects people and provides access to a huge range of goods and services...... strong DPI has three foundational systems—identity, payments, and data exchange—that together can make life easier in important ways".

|

Digital Public Infrastructure – Source World Economic Forum |

Transformational Impact

An article recently posted on the World Economic Forum website sheds light on how Pakistan's digital public infrastructure is transforming lives in rural Pakistan. Here's how it begins:

"On a scorching day with temperatures soaring to 42 degrees, Manzoora, a mother from the flood-stricken district of Shaheed Benazirabad, rural Sindh, Pakistan, made a significant leap: she withdrew cash from her own bank account for the very first time. This milestone was made possible through a mobile cash transfer program initiated by the Sindh government, which partnered with digital service providers to empower citizens like Manzoora. This is just one example of how DPI is changing the lives of millions of Pakistanis".

An earlier UNDP report titled "DigitAll: What happens when women of Pakistan get access to digital and tech tools? A lot!" written by Javeria Masood has also described the socioeconomic impact of technology in Pakistan thus:

"The world as we know it has been and is rapidly changing. Technology has proven to be one of the biggest enablers of change. There has been a significant emphasis on digital training, tech education, and freelancing in the last several years especially during the pandemic, through initiatives from the government, private and development sectors. Covid-19 acted as a big disrupter and accelerated the digital uptake many folds. In Pakistan, we saw the highest number of digital wallets, online services, internet-based services and adaptability out of need and demand".

Digital Identity

NADRA launched a Computerized National Identity Card (CNIC) the same year it was established. It uses biometric data and personal information to confirm the identity of the cardholder as a citizen of Pakistan. The CNIC card is used across the country for voting in elections, opening bank accounts, issuing passports, getting driver's licenses, registering marriages and divorces, completing real estate transactions, participating in social safety net programs like Benazir Income Support, obtaining mobile phone numbers/sims, purchasing tickets for airlines and railways, etc.

The introduction of CNIC was a "foundational change, positioning Pakistan among a select group of nations equipped to manage comprehensive digital identities for over 240 million citizens", according to the World Economic Forum . Within four years of launching the Benazir Income Support Program (BISP) – a social protection initiative to alleviate poverty – CNIC issuance to adults increased by 72%.

|

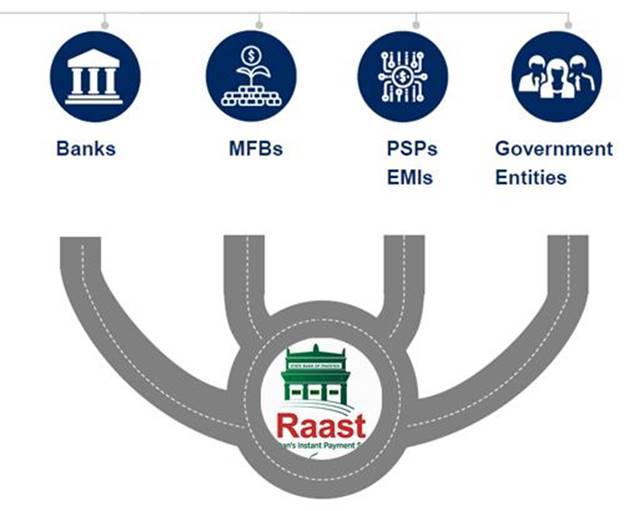

Pakistan Instant Payment System - Source State Bank of Pakistan |

Payments

Digital identity enables payments from the government to citizens as well as financial transactions among individuals, businesses and government entities. The introduction of RAAST , an instant low-cost payment system launched in 2021 by the State Bank of Pakistan, has spurred digital payments in the country. It seamlessly and securely connects government entities, and a variety of banks, including microfinance banks (MFBs), electronic money institutions (EMIs) and State Bank authorized payment service providers (PSPs).

QR Codes

This year, the State Bank of Pakistan has launched P2M (Person to Merchant) services. These allow people with electronic wallets in their mobile phones to pay for goods and services using merchants' QR codes. “The P2M service will enable payment acceptance by businesses using quick response (QR) codes, Raast Alias, IBAN and request to pay (RTP),” the Central Bank said in an announcement.

"All REs (regulated entities) shall enable…capabilities for processing P2M transactions via their delivery channels including mobile apps, internet banking portals, and USSD channels (where applicable) by March 01, 2024." The central bank asked Raast merchant service providers (MSPs) to ensure that customers are not charged any fee on their purchases, by merchants or third parties.

"MSPs may…charge a reasonable fee from merchants for the services provided; however, they are encouraged to initially waive off such charges to promote merchant adoption."

RAAST Uptake

Raast, the State Bank of Pakistan's Instant Payment System, is playing an important role in facilitating free, convenient, and secure real-time transactions across the country, according to a report published by the State Bank of Pakistan . During Q3 of FY24, Raast processed 140 million transactions totaling Rs. 3,437 billion.

Digital transactions took center stage in Pakistan's financial landscape during Q3 FY 2023-24, capturing a commanding 83% of 844 million total retail payments processed by Banks and Electronic Money Institutions (EMIs), while the remaining 17% were Over-the-Counter (OTC) transactions at banks’ branches, reports Mettis Global .

|

Pakistan National Socioeconomic Registry - Source Maintains |

National Socioeconomic Registry

The National Socio-economic Registry has been created. It will be regularly updated to keep it current and deliver services to the Pakistanis most in need. The effort started in earnest in 2020 to hand out Rs 12,000 per family to 3 million most affected by the COVID-19 lockdown. Here's how a Pakistani government website describes the digital registry architecture:

"The Cognitive API architecture for Ehsaas’ National Socio-Economic Registry 2021 is one of the six main pillars of ‘One Window Ehsaas’. With the survey, which is building the registry currently 90.5% complete nationwide, Ehsaas is firming up its plans to open data sharing and data access services for all executing agencies under the Poverty Alleviation and Social Safety Division (PASSD). Data sharing will be done through the Cognitive API Architecture approach. The deployment of Ehsaas API architecture for data sharing will allow executing agencies to access data from the unified registry in real time to validate beneficiary information. This will empower them to ascertain the eligibility of potential beneficiaries".

DPI Future Plans

In future, Pakistan is set to launch several ambitious DPI initiatives, including expanding the RAAST payment system, implementing a nationwide digital health records system, and launching a blockchain-based land registry. These projects promise to drive efficiency and transparency across multiple sectors, positioning Pakistan as a pioneer in the global digital landscape, according to a report by the World Economic Forum .

(Riaz Haq is a Silicon Valley-based Pakistani-American analyst and writer. He blogs at www.riazhaq.com)