|

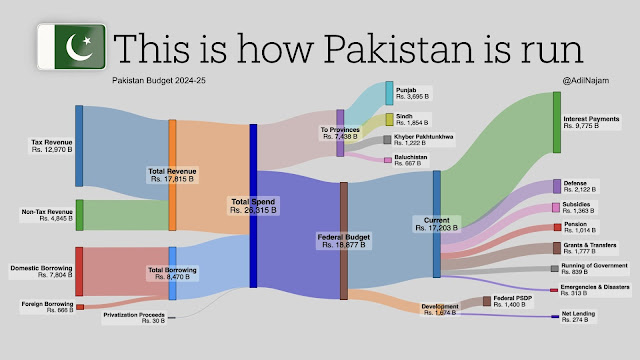

Pakistan's Budget 2024-25 at a Glance - Visualization Courtesy of Prof Adil Najam |

Following the Money: Insights into Pakistan's Budget 2024-25

By Riaz Haq

CA

A look at Pakistan's current fiscal year 2024-25 budget helps gain insights into how the country is run. It shows the money flows from the key sources of revenue and the nation's spending priorities.

Total planned federal spending for the current fiscal year is Rs 8,900 billion (about 69 billion US dollars). This figure does not include the transfer of Rs7,438 (US$ 26 billion) from the federal government to the provinces. Under the 18th Amendment passed in 2010, the federal government is obligated to share 57.5% of its revenue with the provinces. The federal government is primarily responsible for defense , foreign affairs, debt servicing , foreign trade, ports and shipping, and development programs, while food and agriculture , education , healthcare, and housing are devolved to the provinces. There still appears to be some overlap of domestic responsibilities between the federation and the provinces.

The federal government's total revenue is expected to be Rs 17, 815 billion (US$ 65 billion). In addition, Islamabad plans to borrow Rs 8,470 billion ($31 billion) during the fiscal year. Interest payments of Rs 9,775 billion ($ 36 billion) will account for more than half of the federal budget this year. Debt servicing costs will also exceed the planned borrowing (of Rs 8,470 billion) for the year. In other words, all of what the government plans to borrow this fiscal year will be used to service the current debt on the books.

Federal debt servicing costs (Rs 9,775 billion or $35 billion, 9.3% of current GDP) have spiked in recent years due to the State Bank's tight monetary policy designed to fight persistent double-digit inflation. In fact, interest payments on debt are by far the biggest single federal expenditure line item, far surpassing the Rs. 2, 122 billion ($7.7 billion or 2% of current GDP) defense spending. Higher interest rates have also dramatically slowed down the economy.

Pakistani provinces raise some of their revenue on top of the transfers from the federal government. For example, Punjab, the largest of the four provinces, plans to spend an estimated Rs 4,643.4 billion ($17 billion); including the federal transfer of Rs 3,683.1 billion and about Rs 960 billion ($3.5 billion) of provincial tax revenue.

Sindh, the second largest province, has a Rs 3,056 ($11 billion) budget that includes Rs 1,854 billion from the federal government, and Rs 1,202 billion ($4.35 billion) from its revenue sources. KP, the third largest province, has a Rs 1,754 billion ($6.4 billion) budget, including Rs 1,222 billion from the federal government and Rs 532 billion ($1.9 billion) provincial revenue. Balochistan's budget is Rs 956 billion ($3.5 billion) which includes Rs 667 billion from the federal government and Rs 290 billion ($1 billion) from its resources.

Altogether, the federal and provincial governments expect to raise about $75 billion in revenue, representing 20% of $375 billion GDP for fiscal year 2023-24. This is not bad for a developing country like Pakistan. The defense allocation of Rs. 2,122, the second largest federal expenditure, is a mere 2% of the current GDP. The biggest expenditure this year will be the interest payments of Rs 9,775, accounting for over 50% of the federal budget and 9.3% of the current GDP. These debt servicing costs will hopefully come down as the State Bank cuts its interest rates this year and next. Lower interest payments in future years should free up money for other more pressing needs in the areas of education, healthcare, energy, and infrastructure.

(Riaz Haq is a Silicon Valley-based Pakistani-American analyst and writer. He blogs at www.riazhaq.com)