Pakistan Stock Market among World's Best Performers in 2024

By Riaz Haq

CA

Pakistan's KSE-100 index soared 86% in 2024, making it the second best among major indexes, according to Bloomberg News. The top three performing stock markets in 2024 were Argentina (114%), Pakistan (88%) and Kenya (79%), according to Topline Securities. The US markets posted double-digit gains with the AI-driven tech-heavy NASDAQ-100 up 27.6%. Small and medium US companies performed well with the Russell 2000 Index edging out India's Sensex with an 8.9% return.

|

Pakistan among top performing stock markets in 2024 - Source Bloomberg |

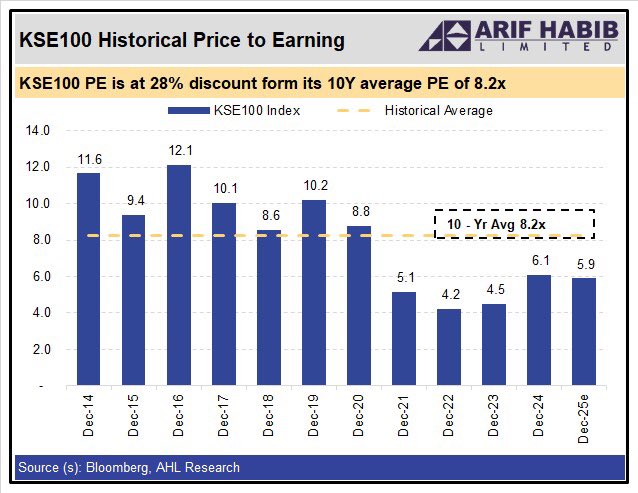

Clearly, the $7 billion IMF program helped restore some investor confidence in Pakistan's economy in 2024. It was also boosted by remittances from overseas Pakistanis in July-October 2024 which soared nearly 35% YoY to $11.8 billion compared to $8.8 billion in July-Oct 2023. The fact that the KSE100 shares' valuation relative to earnings still remains at historic lows (PE ratio of just 5.9) is an indication that investors have doubts about the sustainability of the economic improvements in the country. Among the top investor concerns appear to be the worsening internal security situation and rising political instability.

Pakistan's macroeconomic indicators have significantly improved in 2024. Inflation has come down dramatically, from 29.7% in December 2023 to 4.1% in December 2024, resulting in aggressive monetary easing of 900 bps by the State Bank of Pakistan (SBP). The current account deficit has turned into a surplus of $729 million in November 2024 and the currency has remained stable. Despite the run-up, the KSE 100 2025 forward PE ratio of 5.9x is still substantially below the 10-year average P/E of 8.2x.

|

Pakistan Shares Index PE Ratio - Source Arif Habib |

Pakistan's exports grew to $16.56 billion, an increase of 10.52% in the July-December period in 2024 over the same period in 2023, while imports grew 6.11% to $27.73 billion in this period. The trade deficit in July-December FY25 increased 0.18% to $11.17 billion from $11.15 billion over the prior year. In December, the deficit jumped 34.80% to $2.44 billion from $1.82 billion in December 2023. The trade gap contracted to $24.08 billion in FY24 from $27.47 billion in the preceding year. The current account improvement was helped by remittances from overseas Pakistanis in July-October 2024 which soared nearly 35% YoY to $11.8 billion as compared to $8.8 billion in July-Oct 2023.

In 2024, Pakistan began to make some progress in resolving the economic impact of high electricity rates and rising debt (PKR 2.1 trillion) owed to the independent power producers (IPPs). While the government terminated or renegotiated power purchase contracts (PPAs) with some IPPs, the consumers took matters into their own hands and started an unprecedented solar energy revolution .

As a result of the latest round, PPAs with five IPPs were terminated as a first step. Two of the five IPPs took haircut deals, accepting a discount of up to PKR 20 billion. 18 other IPPs face possible conversion to take-and-pay contracts, whereby the state-owned off-taker will only be liable to pay for energy consumed by the grid, eliminating capacity charges, according to a report by the Institute for Energy Economics and Financial Analysis.

High power prices are fueling a massive solar buildout across Pakistan, according to a Yale360 report . Solar imports from China so far this year have already outstripped imports across all of last year, Bloomberg reports. Panels purchased in 2024 amount to 17 gigawatts of capacity, enough to raise Pakistan's total power capacity by a third. A satellite data analysis done in April by Norwegian firm Atlas revealed around 400 solar plants across the country, clustered mostly in industrial hubs. But many more installations went undetected, the geospatial analysis firm said. Most panels have been deployed almost equally across homes, factories, and farms, solar distributors say.

(Riaz Haq is a Silicon Valley-based Pakistani-American analyst and writer. He blogs at www.riazhaq.com)