Image The Express Tribune

Pakistan Purchasing Managers Index (PMI) Points to Growth in Manufacturing

By Riaz Haq

CA

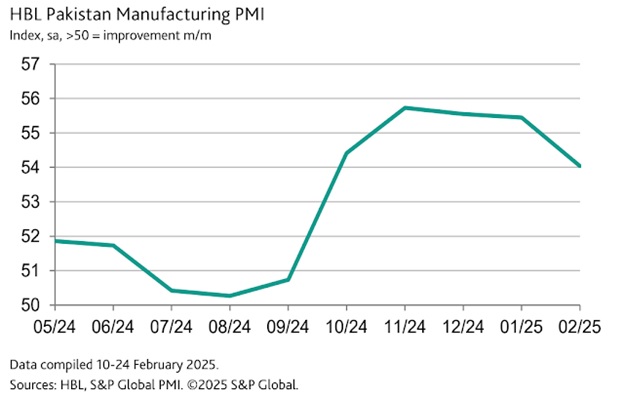

Pakistan Purchasing Manager Index (PMI), jointly launched by Habib Bank (HBL) and S&P Global, has been showing sustained growth in manufacturing for the last several months. It has been consistently above 50, indicating expansion. This indicator disagrees with contraction reported by Pakistan Bureau and Statistics (PBS) Large Scale Manufacturing (LSM) indicator. What accounts for this discrepancy? Is it because the LSM tracks only a subset of industries tracked by PMI? Is there a difference in methodology?

Here's one plausible explanation offered by analyst Humaira Qamar at HBL: "As per the Pakistan Bureau of Statistics, Large Scale Manufacturing (LSM) contracted 1.8% in the latter half of 2024. However, excluding the hefty decline in the low-weight furniture segment, LSM trended positively. Our PMI release suggests that the recovery has extended into 2025, with demand-side conditions taking cue from a sharp reduction in the policy rate".

Another possible explanation for the discrepancy between PMI and LSM can be attributed to the fact that power generation for the grid, a key component of the LSM indicator, is in constant and substantial decline. However, the power generation data tracked by PBS excludes rapidly rising solar electricity production by consumers, including industrial consumers in the country. Pakistan's grid-connected electricity production and electricity consumption are given as around 110 TWh for 2024, but appear to be declining compared to 2023, which contradicts expectations of increasing demand, but could be a sign of the massive expansion of solar energy, according to an article in PV magazine titled ‘The Solar Blitz: How Crisis-ridden Pakistan is Leading the World on the ‘Solar March’. Based on rather imprecise Chinese solar panel export figures and extensive satellite imagery, Bloomberg energy analyst Jenny Chase has concluded that the rapid solar expansion in Pakistan is real.

In August 2024, Chase tweeted as follows: "Pakistan's energy regulator, NEPRA, notes that power consumption is down 9.1% year on year in 2023. NEPRA attributes the drop mainly to high power prices cutting economic activity and making residential consumers curb consumption, with rooftop solar only a third factor. But NEPRA doesn't know how much solar the country has, either. We think it has about 12.7GW of solar already (compared with 50GW on-grid power capacity) and will add 10-15GW of solar in 2024".

In addition to the decline in grid power generation, the reported drag in LSM growth is primarily due to a few

Pakistan PMI Trend. - Source S&P Global

low-weight sub-sectors, which have more than offset positive momentum in key sub-sectors such as textiles, pharmaceuticals, automobiles, and POL (petroleum, oils and lubricants), according to the State Bank of Pakistan, as reported by The Express Tribune .

|

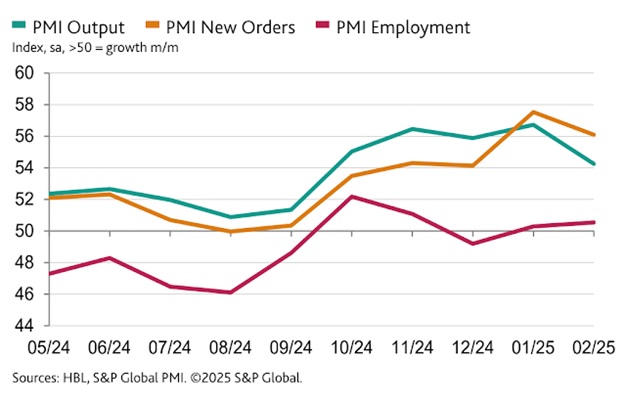

Pakistan Manufacturing Orders, Output and Employment - Source S&P Global |

High-frequency data like monthly PMI help in gauging economic activity in terms of order, output and employment in the manufacturing sector. Here's an excerpt of the HBL/S&P Global PMI report for February 2025 published in March:

Manufacturers in Pakistan also responded to strengthened operating conditions by raising their staffing levels in February, marking the second increase in as many months. Several firms commented that they required additional capacity in response to higher production requirements, while others mentioned longer operating hours. Increased capacity allowed firms to stay on top of outstanding business in February, as indicated by a sustained and steeper fall in backlogs of work. The latest depletion was the most pronounced in five months. Finally, companies expressed confidence in the future path for output during February, with optimism remaining marked overall. This optimism was underpinned by hopes for further new product launches and improvements in product quality, alongside expectations of softer price pressures.

(Riaz Haq is a Silicon Valley-based Pakistani-American analyst and writer. He blogs at www.riazhaq.com)